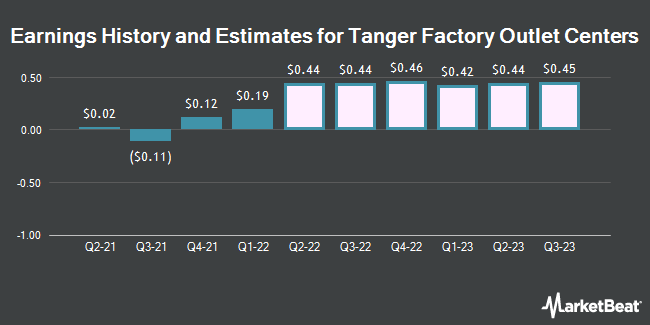

Tanger Factory Outlet Centers, Inc. (NYSE:SKT – Get Rating) – Analysts at KeyCorp reduced their FY2023 EPS estimates for shares of Tanger Factory Outlet Centers in a research note issued to investors on Monday, June 27th. KeyCorp analyst T. Thomas now expects that the real estate investment trust will post earnings of $1.78 per share for the year, down from their prior forecast of $1.79. The consensus estimate for Tanger Factory Outlet Centers’ current full-year earnings is $1.75 per share. Tanger Factory Outlet Centers (NYSE:SKT – Get Rating) last announced its quarterly earnings data on Thursday, May 5th. The real estate investment trust reported $0.19 EPS for the quarter, missing analysts’ consensus estimates of $0.40 by ($0.21). The company had revenue of $108.87 million for the quarter, compared to analyst estimates of $101.62 million. Tanger Factory Outlet Centers had a net margin of 5.84% and a return on equity of 5.04%. The firm’s quarterly revenue was up 8.1% on a year-over-year basis. During the same period in the prior year, the company posted $0.40 EPS.

Other research analysts have also issued research reports about the stock. Compass Point cut their price objective on shares of Tanger Factory Outlet Centers from $23.00 to $21.00 and set a “buy” rating for the company in a research report on Wednesday, June 22nd. StockNews.com began coverage on shares of Tanger Factory Outlet Centers in a research report on Thursday, March 31st. They set a “hold” rating for the company.

This guide will help you identify and execute an options trading strategy that fits your specific needs and risk profile.

Take your trading to the next level with the Options Strategy Guide.

Shares of SKT opened at $14.48 on Wednesday. The company has a 50-day simple moving average of $16.49 and a 200-day simple moving average of $17.26. The firm has a market capitalization of $1.51 billion, a P/E ratio of 65.82, a P/E/G ratio of 1.04 and a beta of 1.76. The company has a debt-to-equity ratio of 2.74, a quick ratio of 2.63 and a current ratio of 2.63. Tanger Factory Outlet Centers has a 52 week low of $13.77 and a 52 week high of $22.51.

Institutional investors have recently modified their holdings of the business. Tompkins Financial Corp grew its stake in Tanger Factory Outlet Centers by 87.5% during the first quarter. Tompkins Financial Corp now owns 1,500 shares of the real estate investment trust’s stock worth $26,000 after buying an additional 700 shares during the last quarter. Cyrus J. Lawrence LLC bought a new stake in Tanger Factory Outlet Centers during the first quarter worth about $28,000. Baldwin Brothers LLC MA bought a new stake in Tanger Factory Outlet Centers during the first quarter worth about $34,000. Mitsubishi UFJ Trust & Banking Corp grew its stake in Tanger Factory Outlet Centers by 299.8% during the fourth quarter. Mitsubishi UFJ Trust & Banking Corp now owns 2,175 shares of the real estate investment trust’s stock worth $42,000 after buying an additional 1,631 shares during the last quarter. Finally, Point72 Hong Kong Ltd bought a new stake in shares of Tanger Factory Outlet Centers during the first quarter valued at approximately $74,000. 82.24% of the stock is currently owned by hedge funds and other institutional investors.

In related news, Director Thomas Reddin sold 10,000 shares of the stock in a transaction dated Monday, May 16th. The shares were sold at an average price of $18.00, for a total value of $180,000.00. Following the completion of the transaction, the director now owns 45,654 shares of the company’s stock, valued at $821,772. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 5.80% of the company’s stock.

The firm also recently declared a quarterly dividend, which was paid on Friday, May 13th. Investors of record on Friday, April 29th were given a $0.20 dividend. This represents a $0.80 annualized dividend and a yield of 5.52%. The ex-dividend date was Thursday, April 28th. This is a positive change from Tanger Factory Outlet Centers’s previous quarterly dividend of $0.18. Tanger Factory Outlet Centers’s dividend payout ratio is 363.65%.

About Tanger Factory Outlet Centers (Get Rating)

Tanger Factory Outlet Centers, Inc (NYSE: SKT) is a leading operator of open-air upscale outlet shopping centers that owns, or has an ownership interest in, a portfolio of 38 centers. Tanger’s operating properties are located in 20 states and in Canada, totaling approximately 14.1 million square feet, leased to over 2,700 stores operated by more than 500 different brand name companies.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected]

Should you invest $1,000 in Tanger Factory Outlet Centers right now?

Before you consider Tanger Factory Outlet Centers, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Tanger Factory Outlet Centers wasn’t on the list.

While Tanger Factory Outlet Centers currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.