GW&K Investment Management LLC boosted its position in shares of US Ecology Inc (NASDAQ:ECOL) by 8.2% during the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 483,020 shares of the business services provider’s stock after purchasing an additional 36,751 shares during the quarter. GW&K Investment Management LLC’s holdings in US Ecology were worth $30,884,000 at the end of the most recent reporting period.

GW&K Investment Management LLC boosted its position in shares of US Ecology Inc (NASDAQ:ECOL) by 8.2% during the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 483,020 shares of the business services provider’s stock after purchasing an additional 36,751 shares during the quarter. GW&K Investment Management LLC’s holdings in US Ecology were worth $30,884,000 at the end of the most recent reporting period.

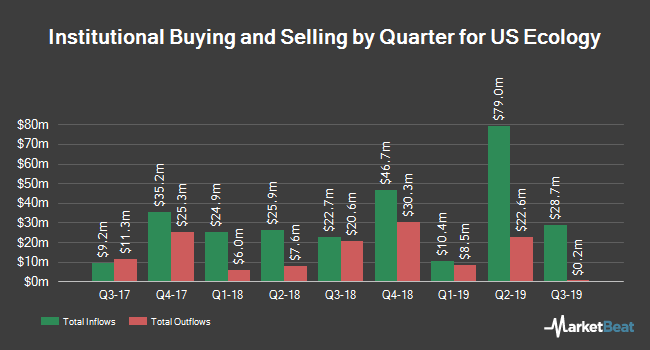

Other hedge funds have also recently made changes to their positions in the company. First Mercantile Trust Co. lifted its stake in US Ecology by 11.6% during the 3rd quarter. First Mercantile Trust Co. now owns 1,685 shares of the business services provider’s stock valued at $108,000 after acquiring an additional 175 shares during the period. Oregon Public Employees Retirement Fund lifted its stake in US Ecology by 2.3% during the 2nd quarter. Oregon Public Employees Retirement Fund now owns 8,736 shares of the business services provider’s stock valued at $520,000 after acquiring an additional 200 shares during the period. US Bancorp DE lifted its stake in US Ecology by 20.0% during the 2nd quarter. US Bancorp DE now owns 1,238 shares of the business services provider’s stock valued at $73,000 after acquiring an additional 206 shares during the period. Arizona State Retirement System lifted its stake in US Ecology by 0.6% during the 2nd quarter. Arizona State Retirement System now owns 34,265 shares of the business services provider’s stock valued at $2,040,000 after acquiring an additional 219 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in US Ecology by 27.4% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,476 shares of the business services provider’s stock valued at $94,000 after acquiring an additional 317 shares during the period. 85.91% of the stock is currently owned by institutional investors.

Shares of NASDAQ:ECOL traded down $0.81 during trading on Monday, hitting $60.14. The company’s stock had a trading volume of 2,737 shares, compared to its average volume of 115,709. The company has a 50-day moving average of $63.36 and a 200-day moving average of $61.18. US Ecology Inc has a 12 month low of $54.24 and a 12 month high of $72.85. The company has a debt-to-equity ratio of 0.95, a current ratio of 2.03 and a quick ratio of 2.08. The firm has a market cap of $1.35 billion, a price-to-earnings ratio of 25.87 and a beta of 0.53.

US Ecology (NASDAQ:ECOL) last issued its quarterly earnings data on Wednesday, October 30th. The business services provider reported $0.75 earnings per share for the quarter, topping the Thomson Reuters’ consensus estimate of $0.74 by $0.01. US Ecology had a net margin of 8.22% and a return on equity of 13.61%. The firm had revenue of $167.40 million for the quarter, compared to analysts’ expectations of $161.25 million. During the same quarter in the prior year, the business earned $0.61 EPS. The business’s quarterly revenue was up 10.6% on a year-over-year basis. As a group, research analysts anticipate that US Ecology Inc will post 2.2 earnings per share for the current year.

The firm also recently disclosed a quarterly dividend, which was paid on Friday, October 25th. Stockholders of record on Friday, October 18th were paid a $0.18 dividend. This represents a $0.72 annualized dividend and a dividend yield of 1.20%. The ex-dividend date was Thursday, October 17th. US Ecology’s dividend payout ratio (DPR) is presently 31.03%.

ECOL has been the topic of several research analyst reports. UBS Group set a $63.00 target price on shares of US Ecology and gave the company a “hold” rating in a research note on Friday, November 1st. ValuEngine upgraded shares of US Ecology from a “hold” rating to a “buy” rating in a research note on Thursday, August 1st. Zacks Investment Research cut shares of US Ecology from a “hold” rating to a “strong sell” rating in a research note on Wednesday, November 6th. Finally, BidaskClub cut shares of US Ecology from a “hold” rating to a “sell” rating in a research note on Tuesday, November 5th. Three investment analysts have rated the stock with a sell rating, one has assigned a hold rating and one has given a buy rating to the stock. US Ecology has a consensus rating of “Hold” and a consensus price target of $67.33.

US Ecology Profile

US Ecology, Inc, through its subsidiaries, provides environmental services to commercial and government entities in the United States, Canada, and Mexico. It operates through two segments, Environmental Services, and Field & Industrial Services. The Environmental Services segment offers hazardous material management services, including transportation, recycling, treatment, and disposal of hazardous, non-hazardous, and radioactive waste at its landfill, wastewater, deep-well injection, and other treatment facilities.

Featured Story: Why is the price target of stocks important?

Want to see what other hedge funds are holding ECOL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for US Ecology Inc (NASDAQ:ECOL).