What happened

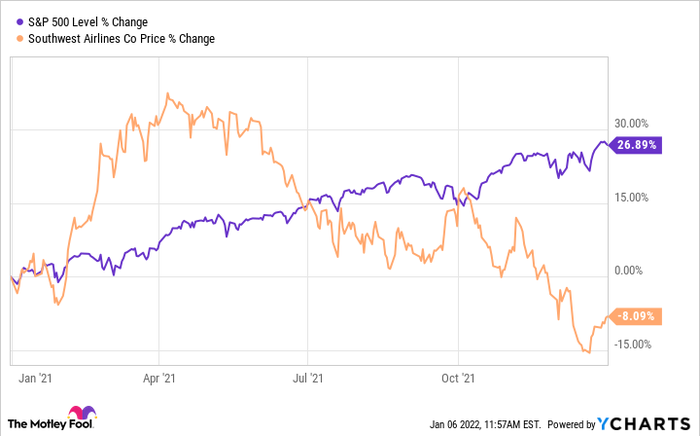

The market had a great year in 2021 in part on growing investor confidence that the pandemic would not wreck the economy. But Southwest Airlines (NYSE: LUV), one of the companies most impacted by COVID-19, failed to go along for the ride. Shares of Southwest finished the year down 8%, according to data provided by S&P Global Market Intelligence, losing to the S&P 500 by more than 34 percentage points.

So what

2020 was a miserable year for airline stocks, but investors had high hopes coming into 2021 that vaccines would unleash significant pent-up demand for travel that would help take airlines higher. Initially, the so-called reopening rally played out exactly as scripted, and by April Southwest was actually up 30% for the year, but the arrival of new variants put a damper on the rally and provided a clear indication that there would be no quick recovery.

Travel has rebounded off of its lows but remains inconsistent and heavily reliant on budget-conscious vacation travelers. Though Southwest is best known as a discounter, it too generates higher margins from business travel, and the uncertainty about when workplaces will be open and sales calls will normalize continues to linger over the stock.

Image source: Southwest Airlines.

Now what

Southwest held its annual investor day in mid-December when management forecasted that 2022 would be a transition year. The virus is likely to continue to mutate, potentially causing further blips and uncertainty, but there does appear to be demand for travel as conditions allow.

Importantly, Southwest is looking past the pandemic to growth. The company’s expansion plans were stalled first by issues with Boeing‘s 737 MAX and then by COVID-19, but airline management during the investor day said they see long-term opportunities both to expand their U.S. domestic marketshare and to grow in international markets, including Mexico, the Caribbean, and Central America.

It’s unclear how well any airline stock can perform as long as the pandemic remains a major focus, but Southwest has a proven track record as the best of the bunch for investors who are willing to wait out the virus. It’s impossible to know what 2022 will bring, but over the long haul, Southwest remains the safest choice for investors looking to buy into a U.S. airline.

10 stocks we like better than Southwest Airlines

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Southwest Airlines wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of December 16, 2021

Lou Whiteman has no position in any of the stocks mentioned. The Motley Fool recommends Southwest Airlines. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.