US Ecology, Inc. (NasdaqGS:ECOL) is scheduled to report Q3 earnings results after markets close for trading on November 5, 2020.

The company is expected to report earnings of $0.13/share on revenue of $237.9 million. The consensus earnings per share (EPS) of $0.13/share is based on a poll of 4 analysts and represents a decline in eps of −82.1% over the same quarter last year, when the company reported earnings of $0.75/share.

The revenue forecast of $237.9 million based on a poll of 5 analysts implies a year-over-year (YoY) growth in revenue of 42.1%. Last year the company reported $167.4 million in revenue for the quarter.

| Metric | Expected | Prior Year | YoY Change |

|---|---|---|---|

| Revenue | $237.85 | $167.40 | 42.1% |

| EPS | $0.13 | $0.75 | −82.1% |

Earnings Call Trends

Historically, management has exceeded analyst expectations 4 out of the last 8 tracked quarters, and missed expectations 4 quarters.

What are your expectations from US Ecology, Inc. for earnings this quarter? Let us know in the comments!

| Quarter | Expected | Reported | Surprise | Result |

|---|---|---|---|---|

| Q2, 2020 | -$0.02 | -$0.08 | -270.7% | Missed |

| Q1, 2020 | $0.14 | $0.12 | −15.2% | Missed |

| Q4, 2019 | $0.55 | $0.38 | −31.0% | Missed |

| Q3, 2019 | $0.74 | $0.75 | 1.6% | Beat |

| Q2, 2019 | $0.61 | $0.66 | 9.1% | Beat |

| Q1, 2019 | $0.32 | $0.22 | −31.0% | Missed |

| Q4, 2018 | $0.60 | $0.65 | 7.7% | Beat |

| Q3, 2018 | $0.62 | $0.70 | 12.4% | Beat |

In the following table, we summarize the company’s stock price movements after earnings releases. The “Price Day Prior” column shows the closing stock price on the day before the earnings report, and the “Price Next Day” column shows the stock price at the end of the trading day after the earnings report. After the last earnings report for the period ending June 30, 2020, the stock price reacted by increasing 3.1%.

| Report Date | Price Day Prior | Price Next Day | Change % | Result |

|---|---|---|---|---|

| August 6, 2020 | $36.57 | $37.72 | 3.1% | Increase |

| May 7, 2020 | $30.52 | $31.11 | 1.9% | Increase |

| February 26, 2020 | $48.59 | $44.35 | −8.7% | Decline |

| October 30, 2019 | $64.90 | $62.23 | −4.1% | Decline |

The other question to consider is one of earnings manipulation. There is a lot of pressure on management each quarter to deliver on earnings expectations. The Beneish M-Score is a statistical model that provides some insight into whether the company might be manipulating earnings. With a Beneish M-Score of −3.09, the model suggests that the company is not likely to be an earnings manipulator. A value of −3.09 implies a 0.1% chance of earnings manipulation.

Fundamentals And Technical Analysis

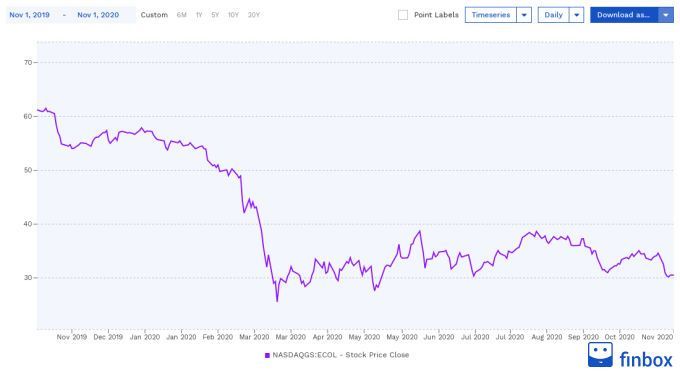

US Ecology, Inc. is currently trading at $30.52/share, up 1.1% for the day. The company is trading at approximately 46.9% of its 52-week high of $65.13/share. The company’s stock price is down −19.1% since the last earnings report and down −11.8% over the previous week. The company’s 14 Day Relative Price Index (RSI) of 33.53 suggests the company is trading in technically neutral territory. The RSI is considered overbought when above 70 and oversold when below 30.

The current share price implies a price-to-earnings (P/E) multiple of −3.24 and a forward P/E multiple of 55.46.

US Ecology, Inc.’s current share price also implies a price-to-book (P/B) multiple of 1.41. The following table summarizes some other key fundamental ratios:

| Metric | Value |

|---|---|

| Last Reported Fiscal Period Key | FY2020.Q2 |

| Period End Date | June 30, 2020 |

| Stock Price (Current) | $30.52 |

| P/E Ratio | −3.2x |

| P/E Ratio (Fwd) | 55.5x |

| PEG Ratio | 0.0 |

| Total Debt / Total Capital | 50.3% |

| Levered Free Cash Flow | $30.868 million |

| EV / EBITDA | 10.9x |

US Ecology, Inc. is a small-cap stock with a market capitalization of $950.4 million and a total enterprise value of $1.778 billion. The company operates in the Industrials sector and the Commercial Services & Supplies industry.

US Ecology, Inc., through its subsidiaries, provides environmental services to commercial and government entities in the United States, Canada, Europe, the Middle East, Africa, Mexico, internationally. It operates through two segments, Environmental Services, and Field & Industrial Services. The Environmental Services segment offers specialty material management services, including transportation, recycling, treatment, and disposal of hazardous, non-hazardous, E&P, and radioactive waste at its landfill, wastewater, deep-well injection, and other treatment facilities. The Field & Industrial Services segment provides specialty field services, which includes standby services, emergency response, industrial cleaning and maintenance, remediation, lab packs, retail services, transportation, and other services; and waste management services, such as on-site management, waste characterization, and transportation and disposal of non- hazardous and hazardous waste to commercial and industrial facilities, and government entities. US Ecology, Inc. serves oil refineries, chemical production plants, steel mills, real estate developers, and waste brokers/aggregators serving small manufacturers, and other industrial customers. The company was formerly known as American Ecology Corporation and changed its name to US Ecology, Inc. in February 2010. US Ecology, Inc. was founded in 1952 and is headquartered in Boise, Idaho.