South Korea-based steelmaker Posco Holdings has been deploying in sourcing and supplying materials for second-life battery for electric vehicle (EV) and energy storage.

It has partnered with British battery maker Britishvolt, American automaker General Motors, Taiwan-based solid-state battery maker ProLogium, Indonesian steel maker Krakatau Steel, and Indian renewable energy supplier Greenko. South Korea-based battery maker LGES is also Posco’s client.

Lithium mining, battery recycling

According to Reuters, Posco announced in March this year that it is investing up to US$4 billion in a lithium mining project in Salta, Argentina. The project is expected to produce 100,000 tons of lithium hydroxide in total.

Earlier this month, the company announced that it has completed constructing a second-life battery recycling plant in Brzeg Dolny, Poland. The plant will be co-run with SungEel HiTech, a Korean battery recycling technology provider.

The recycling plant has an annual capacity of 7,000 tons and will collect used batteries from mainly Europe.

The Posco Group has been investing and developing technologies for lithium and nickel since it entered the business in 2010. It plans to achieve KRW41 trillion (US$30 billion) in sales by building a stable secondary battery material value chain by 2030, producing 300,000 tons of lithium, 220,000 tons of nickel, 610,000 tons of cathode materials, and 320,000 tons of anode materials.

Cathode materials

Posco Chemical announced that it has signed a mid- to long-term contract amounting US$804 million with a local client to supply cathode materials for energy storage system.

The company also signed a US$10.8 billion contract with Ultium Cells this year to supply cathode materials for battery for three years, according to South Korean news outlet Aju Business Daily. Ultium Cells is a joint venture formed by General Motors and LGES.

Posco Chemical currently produces cathode materials in Gwangyang, South Korea. The Gwangyang plant is expected to have a total annual capacity of 90,000 tons by the end of 2022, according to JoongAng Daily.

To further secure material sources, the company has agreed to build a joint venture plant in Quebec, Canada to produce high-nickel cathode materials with Ultium Cells, Aju Business Daily reported.

Indonesia

According to Reuters, Posco’s joint venture in Indonesia, Krakatau POSCO, is on the path of becoming the largest integrated steel supplier in Southeast Asia.

Posco has been investing in Indonesia for steel production since 2010. The company’s joint venture with Indonesian steel producer Krakatau recently announced that it is investing US$3.5 billion to expand production capacity to 100 million tons per year.

Additional production will be used to supply for automotive products including EV.

Posco’s presence in Indonesia is expanding as the company also works with LGES in Indonesia to secure nickel supply. The project with LGES is said to be up to US$9.8 billion, according to Reuters.

|

Posco’s recent deployment related to EV |

|||

|

Product |

Location |

Partner |

Capacity / volume |

|

Cathode Materials |

Gwangyang, South Korea |

N/A |

Ramping up from 30,000 to 90,000 tons this year |

|

Cathode Materials |

Quebec, Canada |

Ultium Cells |

Not disclosed |

|

Steel products for steel and EV |

Indonesia |

Krakatau |

Ramping up from 3 million tons to 10 million tons |

|

Nickel products for battery |

Indonesia |

LGES |

Not disclosed |

|

Battery recycling |

Brezg Dolny, Poland |

SungEel HiTech |

Not disclosed |

|

Lithium hydroxide |

Salta, Argentina |

N/A |

100,000 tons in sum |

|

Hydrogen |

India |

Greenko |

Not disclosed |

|

Solid-state battery materials including solid electrolyte |

Not disclosed |

ProLogium |

Not disclosed |

|

Anode and cathode materials |

Not disclosed |

Britishvolt |

Not disclosed |

|

Silicone anode |

South Korea |

Tera Technos (acquisition) |

Not disclosed |

Source: Public information, compiled by DIGITIMES ASIA, September 2022

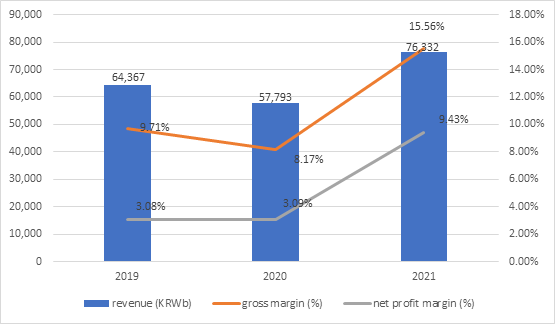

Posco Holdings consolidated income, 2019-2021

Source: Posco, compiled by DIGITIMES ASIA, September 2022