Fritz Jorgensen/iStock via Getty Images

A Quick Take On E2open Parent

E2open (NYSE:ETWO) reported its FQ1 2023 financial results on July 11, 2022, meeting expected revenue and beating EPS estimates.

The company provides companies with a suite of supply chain management and logistics software tools.

Management continues to invest in adding headcount, which is a concern heading into a slowdown or outright recession.

Over the longer term, ETWO may be improving its position in the SCM space with its acquisition and rebranding efforts, but I’m on Hold for the near term.

E2open Parent Overview

Austin, Texas-based E2open was founded to provide a cloud-based integrated supply chain management platform for global companies.

In February 2021, the company merged with SPAC CC Neuberger Principal Holdings I at a valuation of approximately $2.6 billion, bringing the company public again.

Later in 2021, the company acquired logistics software company BluJay Solutions for around $1.7 billion.

The firm is headed by Chief Executive Officer Michael Farlekas, who was previously General Manager at Roadnet Technologies and SVP and GM at RedPrairie.

The company’s primary offerings include:

-

Channel management

-

Export/Import compliance

-

Logistics management

-

Intelligent analytics and decision support

ETWO acquires customers through its direct sales and marketing efforts as well as through partners.

80% of the firm’s revenue is from subscription customers.

E2open’s Market & Competition

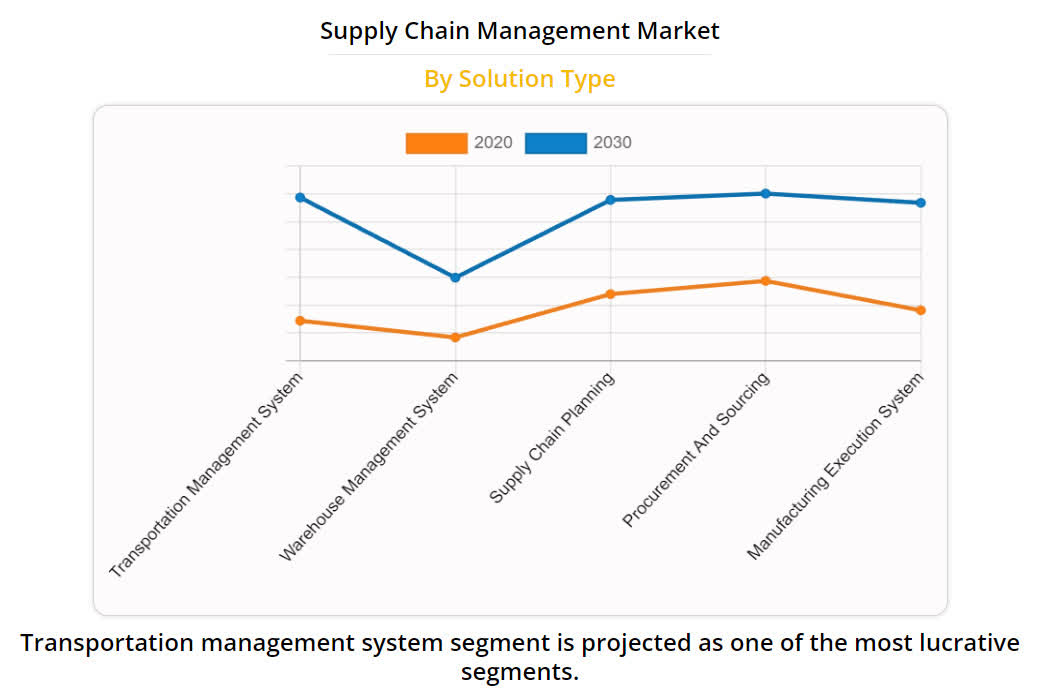

According to a 2021 market research report by Allied Market Research, the market for supply chain management software and services was an estimated $18.7 billion in 2020 and is forecast to reach $52.6 billion by 2030.

This represents a forecast CAGR of 10.7% from 2021 to 2030.

The main driver for this expected growth is demand for increased supply chain visibility, especially after the disruptions caused by the COVID-19 pandemic.

Also, the chart below shows the supply chain management market changes between 2020 and 2030, by solution type:

SCM Market By Solution (Allied Market Research)

Major competitive or other industry participants include:

-

Epicor Software

-

HighJump

-

Info

-

IBM

-

JDA Software Group

-

Kinaxis

-

Manhattan Associates

-

Oracle

-

SAP

-

Descartes Systems Group

-

Others

E2open Parent’s Recent Financial Performance

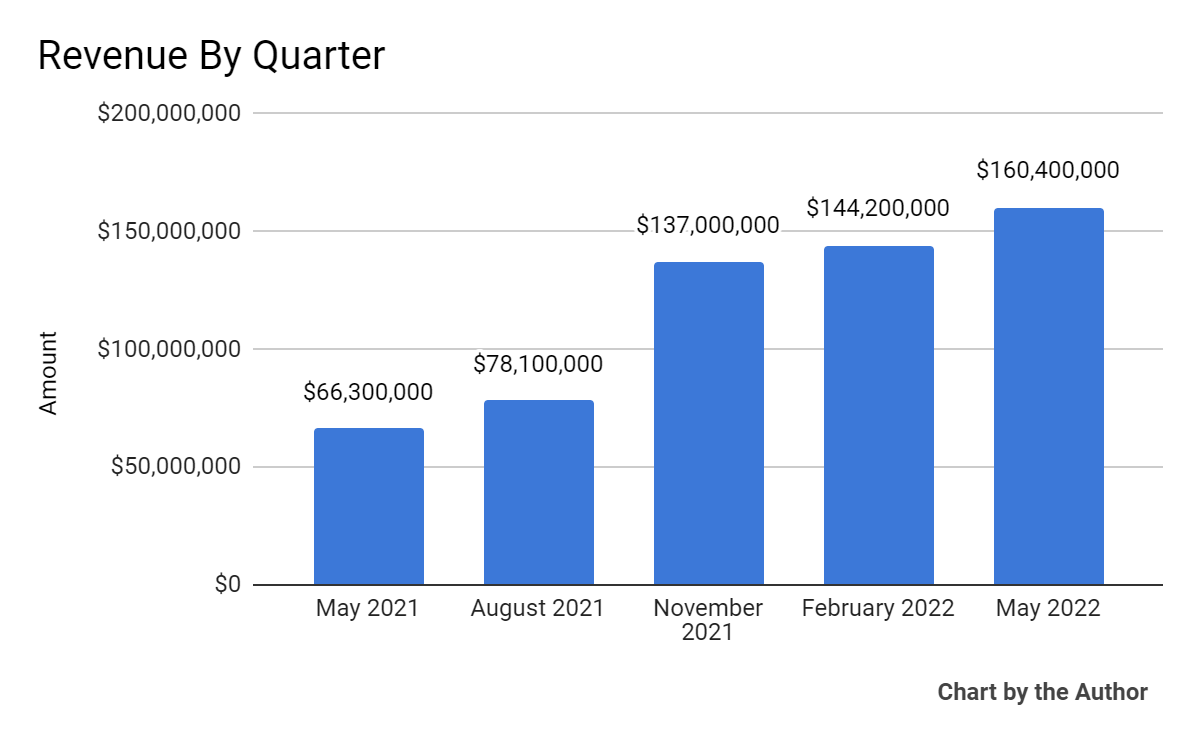

-

Total revenue by quarter has risen sharply in recent quarters, due in part to inorganic revenue growth from its BluJay Solutions acquisition:

5 Quarter Total Revenue (Seeking Alpha)

-

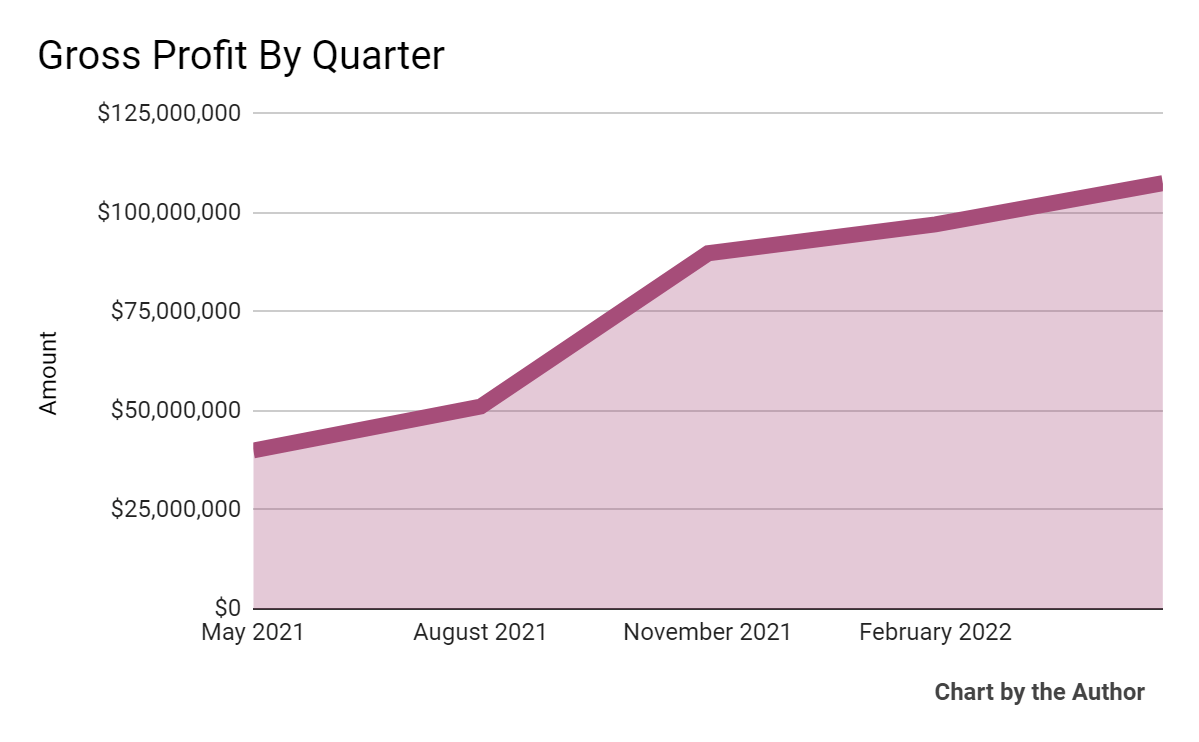

Gross profit by quarter has also grown quickly:

5 Quarter Gross Profit (Seeking Alpha)

-

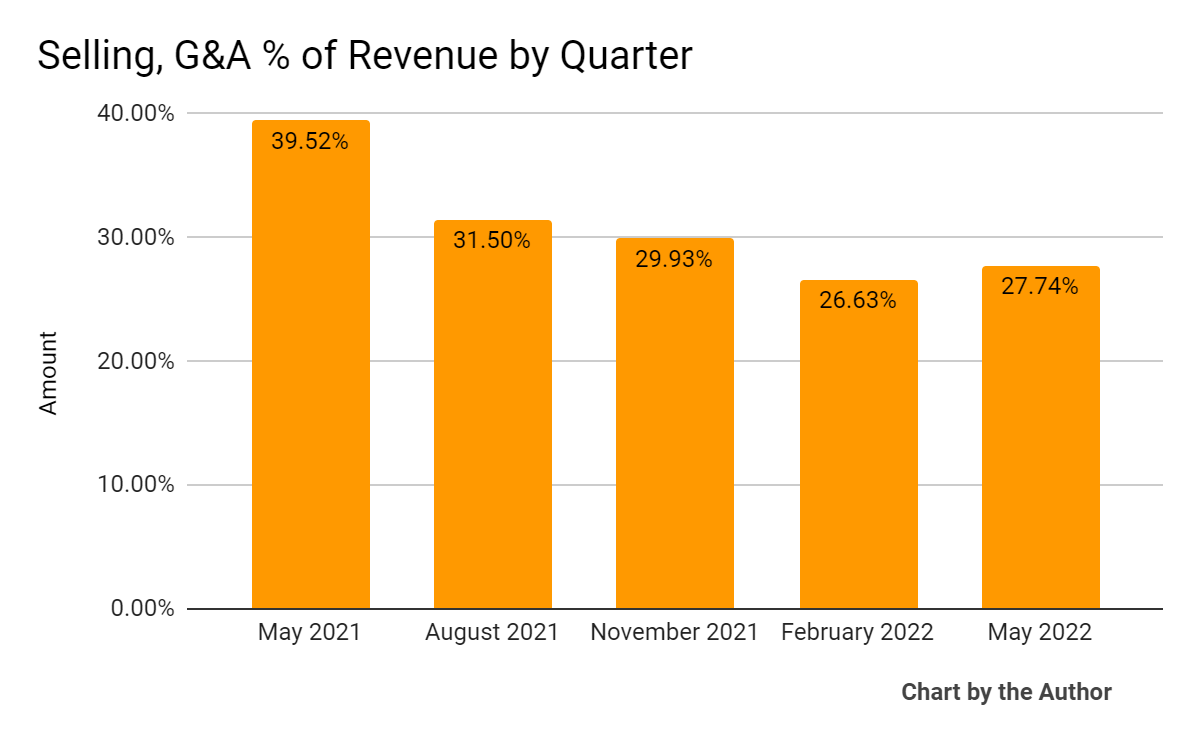

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

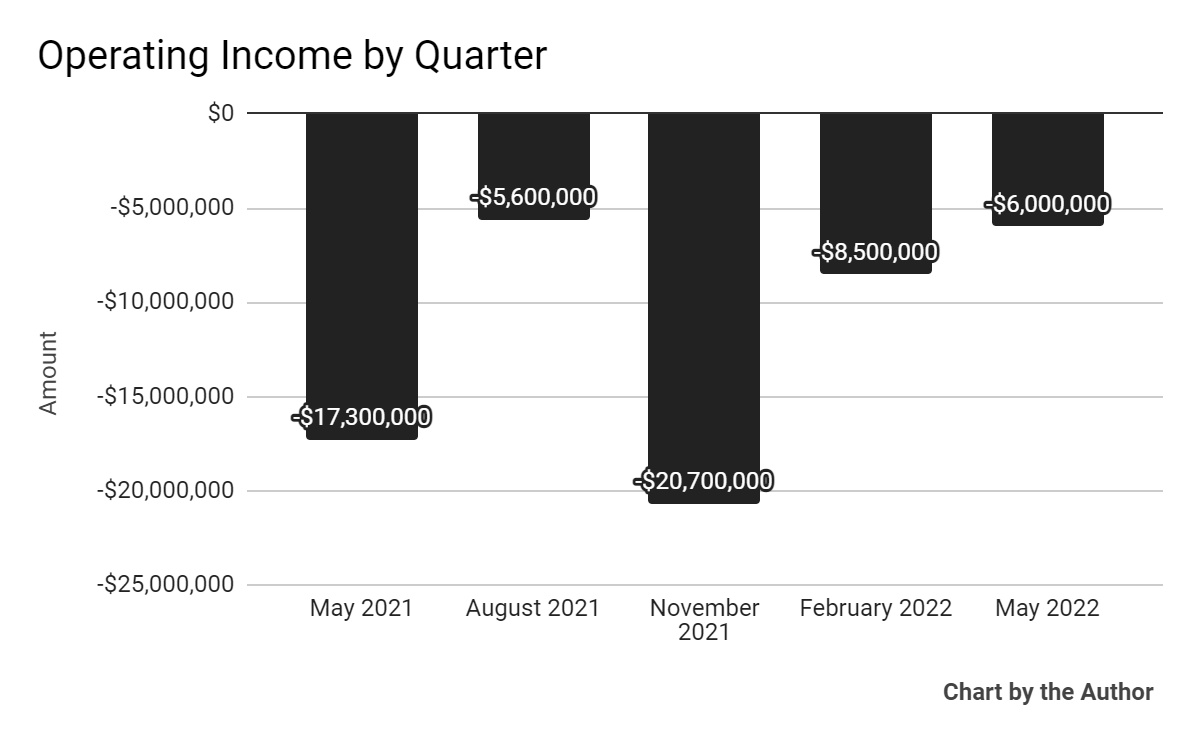

Operating income by quarter has remained negative, as the chart shows below:

5 Quarter Operating Income (Seeking Alpha)

-

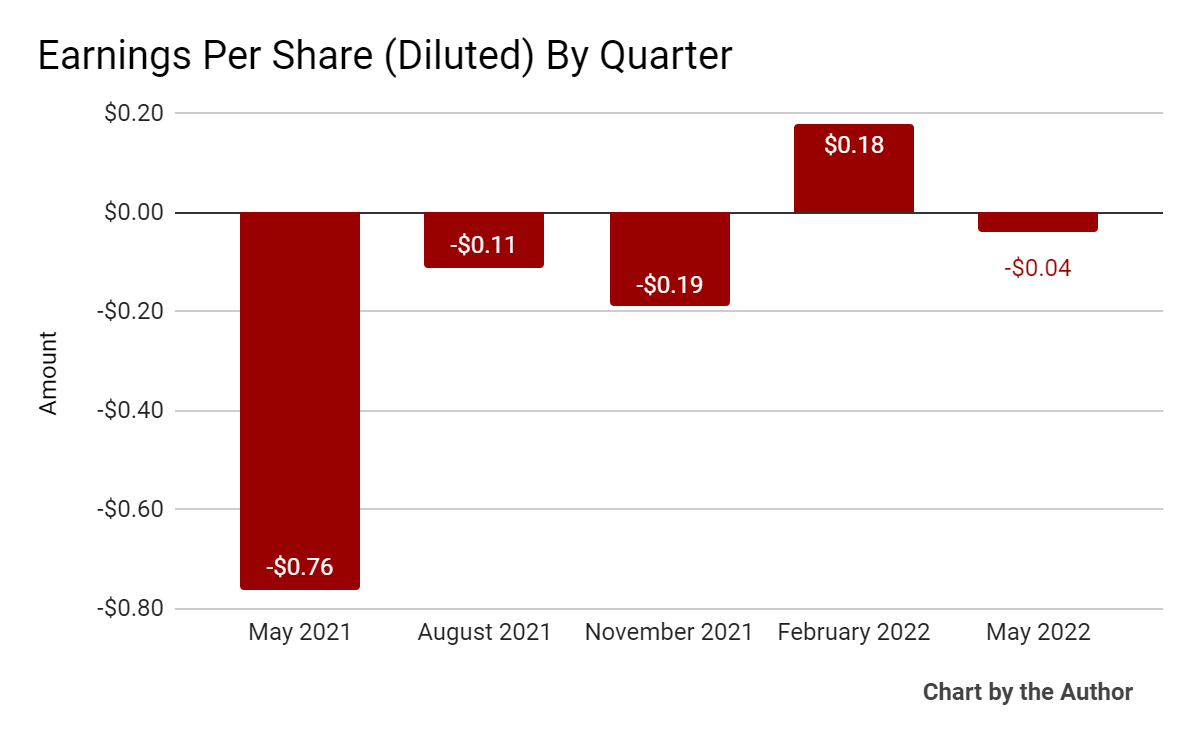

Earnings per share (Diluted) have narrowed their loss in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

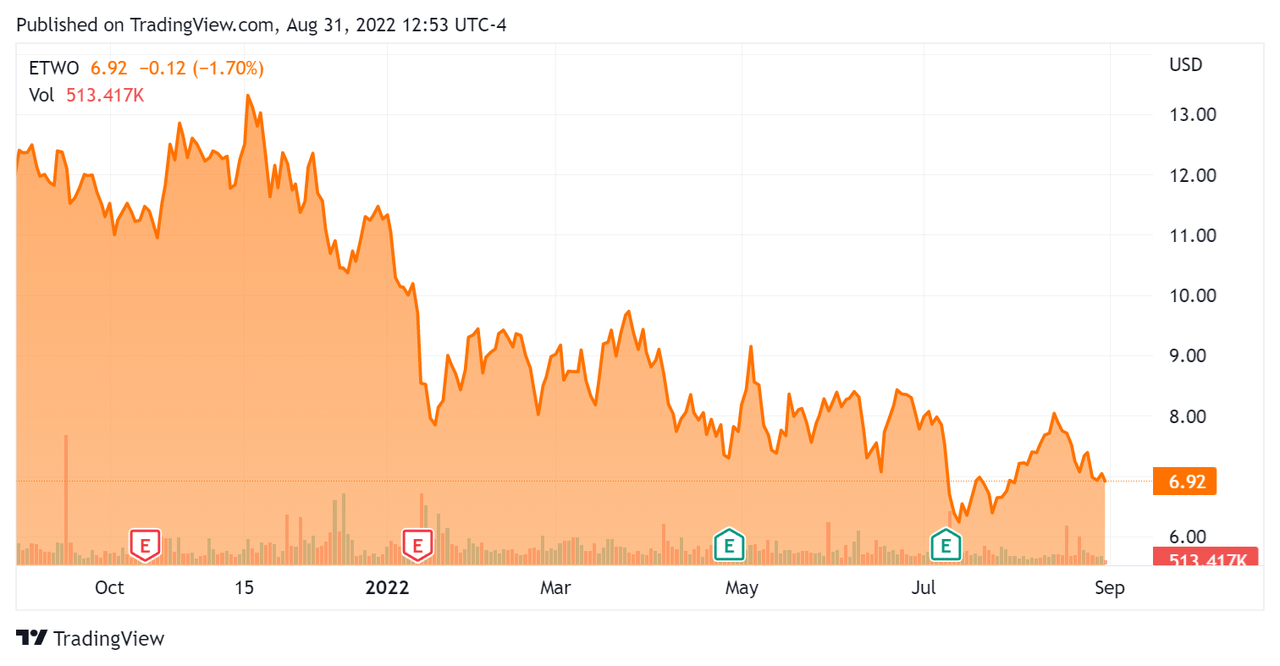

In the past 12 months, ETWO’s stock price has fallen 42% vs. the U.S. S&P 500 index’s drop of around 12.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For E2open

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.52 |

|

Revenue Growth Rate |

66.0% |

|

Net Income Margin |

-6.7% |

|

GAAP EBITDA % |

26.0% |

|

Market Capitalization |

$2,360,000,000 |

|

Enterprise Value |

$3,390,000,000 |

|

Operating Cash Flow |

$36,770,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.16 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Manhattan Associates (MANH); shown below is a comparison of their primary valuation metrics:

|

Metric |

Manhattan Associates |

E2open |

Variance |

|

Net Income Margin |

16.7% |

-6.71% |

-140.2% |

|

Revenue Growth Rate |

14.8% |

26.0% |

75.4% |

|

Operating Cash Flow |

$184,270,000 |

$36,770,000 |

-80.0% |

|

Enterprise Value / Sales |

12.2 |

6.5 |

-46.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ETWO’s most recent GAAP Rule of 40 calculation was 92% as of FQ1 2023, so the firm has performed quite well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

66.0% |

|

GAAP EBITDA % |

26.0% |

|

Total |

92.0% |

(Source – Seeking Alpha)

Commentary On E2open

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted the company’s subscription revenue growth, which accounts for 80% of total revenue and grew by 12% organically on a constant currency basis year-over-year.

However, CEO Farlekas noted seeing a slowing economy, both domestically in the U.S. and internationally.

Also, demand slowdown is manifesting in lengthening sales cycles, especially in the European market and in the technology sector.

The firm continues to pursue partnerships where relevant and concluded or expanded deals with Accenture and Uber Freight recently.

As to its financial results, revenue rose by 11.4% on a constant currency basis, while gross margin percentage dropped slightly year-over-year.

Subscription revenue growth was 12.1% on a constant currency basis.

Remarkably, management did not disclose the company’s retention results, which is important to determining churn, product/market fit and the efficiency of its sales & marketing strategies.

The company has spent considerable time and money ramping up its sales and marketing teams over the past year, although SG&A as a percentage of total revenue has been trending lower, a positive signal.

For the balance sheet, the firm finished the quarter with $129.2 million in cash and equivalents and had long-term debt of $1.05 billion.

Looking ahead, management reiterated previous fiscal 2023 guidance with a slight reduction of results due to expected negative foreign exchange rate fluctuations.

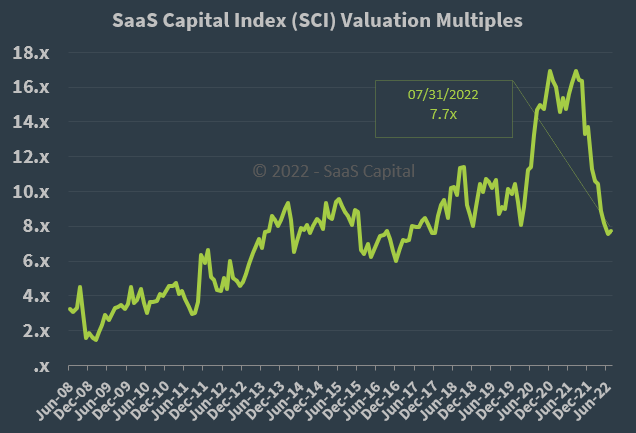

Regarding valuation, the market is valuing ETWO at an EV/Sales multiple of around 6.5x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ETWO is currently valued by the market at a slight discount to the broader SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a macroeconomic slowdown or recession, which is beginning to slow its sales cycles and reduce its revenue growth trajectory.

Also, the strong dollar relative to other major currencies it receives payment in will likely put a damper on results.

While management continues to invest in adding headcount, a concern is to continue that heading into a slowdown or outright recession.

Over the longer term, ETWO may be improving its position in the SCM space with its acquisition and rebranding efforts, but I’m on Hold for the near term.