alvarez/E+ via Getty Images

Shipping stocks have been among the few areas of the stock market that are weathering the volatility well. The pandemic brought about supply disruptions and logistical nightmares, but firms that can actually get products and commodities to commercial customers are worth their weight in gold right now. Diana Shipping (NYSE:DSX) operates as a holding company, which engages in the provision of shipping transportation services through the ownership and operation of dry bulk vessels, according to The Wall Street Journal.

The company’s vessels are employed via long-term charters. What do the ships carry? Key commodities such as iron ore, coal, and grains. Other important materials are transported worldwide, too.

Shares Are Cheap

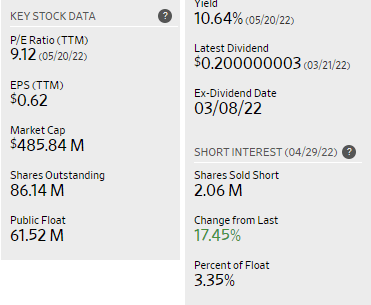

The $485 million market cap Athens, Greece-based Industrials sector stock features a price-to-earnings ratio under 10x. It grew revenue by an average of 6.5% per year over its previous five fiscal years, according to WSJ and company data. The stock features a whopping 10.6% dividend yield.

Low P/E, High Yield

The Wall Street Journal

Profits have “come about” with Diana. For the most recent quarter, net income grew from a $7 million loss to a $41 million profit year-on-year for the quarter ending December 31.

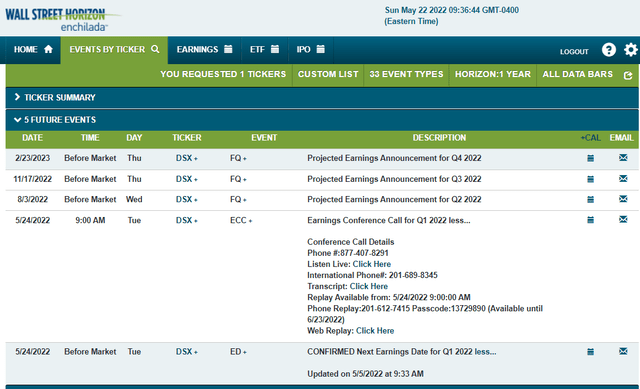

Earnings on Tap Tuesday Morning

On the corporate event calendar, Wall Street Horizon reports that DSX reports its Q1 earnings this week. Tuesday morning’s confirmed earnings date will be followed by a company conference call.

Corporate Event Calendar

Wall Street Horizon

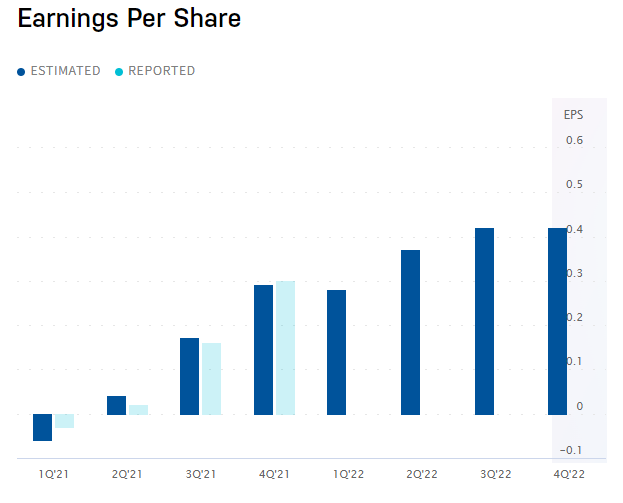

Analysts expect $0.28 of EPS, according to Nasdaq.com. Profit trends look favorable, too.

Nasdaq.com

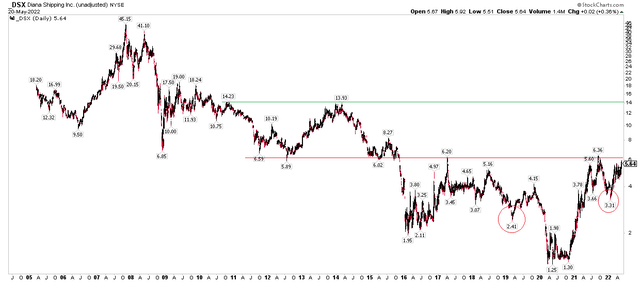

The Technical Take

Turning to what really matters for traders: the charts. I like this risk/reward setup. The stock probed long-term resistance near the $6 mark in late 2021 but then corrected big-time back down to $3.31 earlier this year. A strong thrust over the last few months brings shares back to “the scene of the crime” near $6 once again. If we get a sustained move above this critical $6 figure, the stock likely heads to previous resistance near $14.

A Bullish Head & Shoulders Pattern?

What also appeals to me about the chart is a bit of a head and shoulders bottom. $2.41 and $3.31 circled below act as the shoulders while the horizontal resistance line can be thought of as the neckline. A breakout would make for a measured move just above $11 based on that pattern.

StockCharts

Momentum

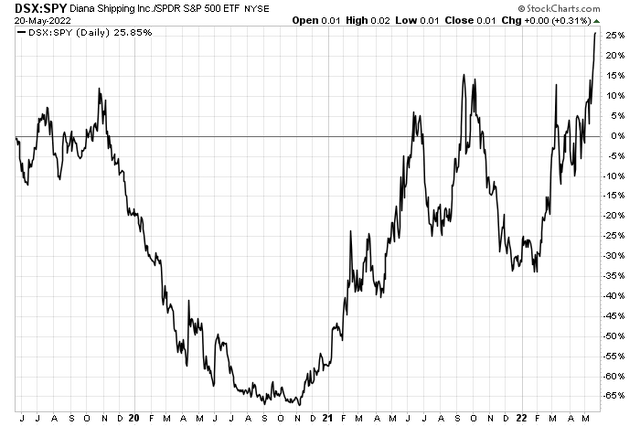

Traders should also pay attention to relative strength. Diana recently broke out to fresh 3-year relative highs vs the S&P 500 ETF (SPY). Clearly, money is moving into this stock. With the breakout comes the presumption that momentum continues.

DSX: Relative Strength

StockCharts

Bottom Line

Diana Shipping has some big tailwinds right now amid a cheap valuation, high dividend yield, favorable stand-alone technical, and impressive relative strength. I like the stock on a weekly close above last year’s peak of $6.36 with a target price of $14.