How do some of the world’s most famous branded companies continue to dominate mind share and market share in an ever more disruptive world of e-commerce and social media? It is a question on which we have become increasingly focused. The answer for consumer goods companies lies in staying relevant to the consumer’s changing preferences and values, for example the use of natural or organic ingredients or more environmentally friendly packaging. Consumer goods companies that stay relevant can gain market share and maintain pricing power over competitors who do not. This often results in rising long-term returns as a consequence. Further, governance structure really matters – we typically prefer agile and decentralised management teams that can react to local market conditions, choose to invest in their franchises and do not squander free cash flow on low return acquisitions.

Not all strong franchise companies are consumer brands. Recurring revenues from networks can also mean compelling stability of earnings, even more so with the shift to the cloud. For the software and IT services companies in which we choose to invest, staying relevant means supporting other businesses in their changing digital needs and being cautious with the use of data. Medical technology has also offered new ground for us to identify robust recurring revenues in areas such as medical equipment. life sciences and diagnostics.

Importantly, we do not analyse companies from a distance. Portfolio managers handle proxy voting directly, meeting regularly with the senior management, board members and remuneration committees of companies we own, and engage where we must. Often that means focusing on incentive structures, which in our view can be critical to the decisions of management, or checking management’s awareness and agility on their company’s environmental or social footprint or the shifting tide of opinion from regulators and consumers on data protection and antitrust.

An active portfolio to defend against today’s uncertain markets

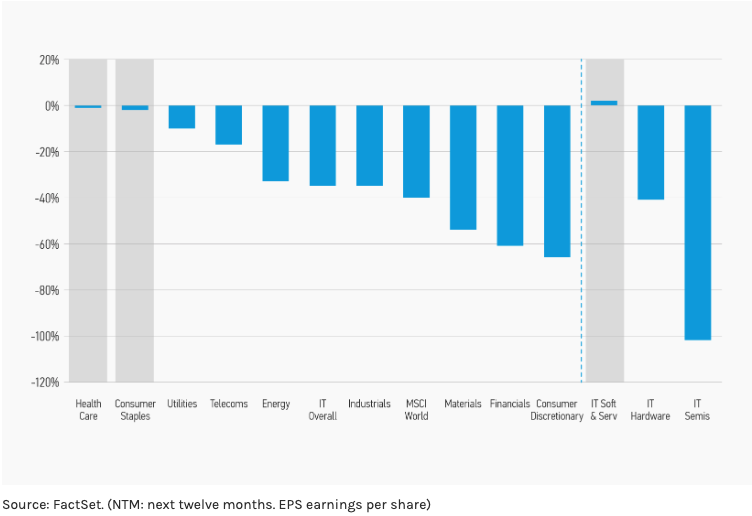

High quality companies are by their nature less exposed to potential adverse events, as demonstrated by our strategy’s history of relative outperformance in down markets. Even more interesting perhaps is a closer look at the sustainability of earnings across different sectors during the last financial crisis. Earnings of software and services companies were up 2% over 18 months, against a 40% fall for the MSCI World Index, while health care and consumer staples were only down marginally (Display 1).