This story is part of a Supply Chain Dive series on reshoring supply chains.

For decades, supply chains extended their reach and embraced globalization. Manufacturers popping up in developing nations offered the promise of skilled labor at a low cost.

But recent factors have eroded the cost competitiveness of production and imports from China. The country’s middle class emerged and wages are rising. Tariffs bumped up the price of imports by up to 25%. Buyers focused more awareness on upstream risks of human labor, intellectual property violations and sustainability. And most recently, the COVID-19 pandemic led to skyrocketing airfreight rates and peak-season-level ocean freight prices.

The appeal of globalization for many supply chains lessened, and moves to Mexico or the U.S. became attractive. But with deep roots in China, a mass exodus is unlikely. Rather, China +1 is gaining popularity.

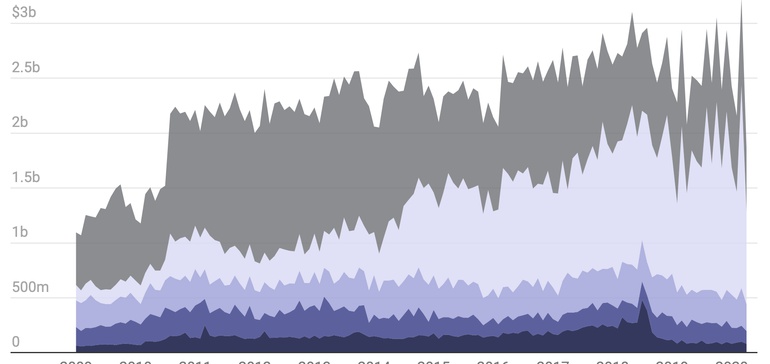

The charts below demonstrate diverging trends related to global trade and reshoring — in some cases supply chains are moving closer to home, but in others, manufacturing remains overseas.