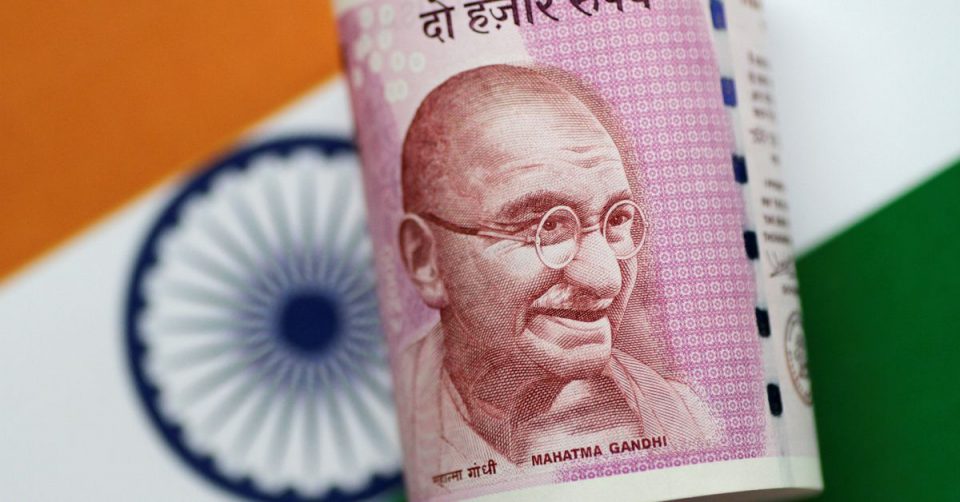

An India Rupee note is seen in this illustration photo June 1, 2017. REUTERS/Thomas White/Illustration

Register now for FREE unlimited access to Reuters.com

Aug 4 (Reuters) – The Indian rupee declined against a strong dollar on Thursday as the country’s record trade deficit remained a cause for concern ahead of the Reserve Bank of India’s monetary policy decision due at the end of the week.

The partially convertible rupee was trading at 79.44 per dollar by 0504 GMT, having weakened up to 79.54 during the session, and hovered near levels it hit last week. The unit closed at 79.16 on Wednesday.

India’s July preliminary trade deficit widened to $31.02 billion from $10.63 billion a year earlier, as the country spent more on crude oil and coal imports, a government official said late on Tuesday.

Register now for FREE unlimited access to Reuters.com

“A large trade deficit is indeed a problem for the rupee as it creates a greater need for dollar funding, especially when portfolio inflows have dried up, or are recording outflows,” said Dhiraj Nim, a foreign exchange strategist and economist with ANZ Research.

A Reuters poll of FX strategists showed the unit was expected to trade near its historic low in the coming three months. The rupee hit an all-time low last month at 80.05 per dollar.

Following the trade deficit data, analysts have said the possibility of a 50-basis-point hike by the country’s central bank looks very likely.

“A sizable rate hike will help the rupee by preventing a sharp narrowing of the interest rate differential,” Nim said, adding that inflation risks remain and the U.S. Federal Reserve was likely to deliver large rate hikes to battle its own inflation issues.

The dollar was firmer on the same hopes.

Register now for FREE unlimited access to Reuters.com

Reporting by Anushka Trivedi in Mumbai; Editing by Shounak Dasgupta

Our Standards: The Thomson Reuters Trust Principles.