Welcome to another edition of my monthly 7 Dividend Growth Stocks series in which I present seven high-quality dividend growth stocks for further analysis and possible investment.

I apply different screens every month to narrow down my watch list of more than 730 dividend growth stocks, Dividend Radar. Changing the screens from month to month highlights different aspects of dividend growth [DG] investing. For example, value investors tend to look for deep discounts, income investors prefer higher-yielding stocks, and growth-oriented investors favor higher DG rates.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

This month, I used a defensiveness scoring system developed by David Van Knapp as my primary screen. The system awards points based on satisfying common notions of safety rather than for being in a certain economic sector. Additionally, I screened for stocks trading below my risk-adjusted Buy Below prices.

I ranked candidates that passed both screens using DVK Quality Snapshots and my ranking system.

In case you missed previous articles in this series, here are links to them:

About Defensiveness

There are at least three classification systems that group stocks based on sectors or industries. I use the Global Industry Classification Standard (GICS), a market-based system also employed by the S&P 500 Index.

Sectors can be further categorized into super sectors based on how they tend to perform during different phases of the business cycle:

- Defensive Sectors: Consumer Staples, Health Care, Utilities

- Cyclical Sectors: Consumer Discretionary, Financials, Materials, Real Estate

- Sensitive Sectors: Communication Services, Energy, Industrials Information Technology

Defensive Sectors are not closely tied to the economy because companies in these sectors provide goods and services that are always in demand.

While the categorization of stocks into super sectors by their sector membership is useful, David Van Knapp notes a shortcoming in the approach. Specifically, stocks belonging to Defensive Sectors may have non-defensive characteristics, while stocks from Cyclical and Sensivitve Sectors may have defensive characteristics.

Instead, David Van Knapp suggested identifying “safe” companies regardless of sector membership and grouping them together in a list of defensive stocks. He developed a scoring system based on the following “common notions of safety”:

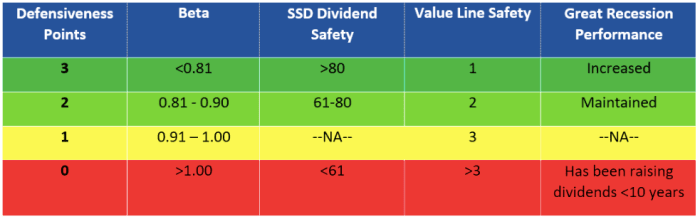

Defensiveness scoring system developed by David Van Knapp (source: A Different Look At ‘Defensiveness’).

Stocks with lower Beta’s, higher SSD Dividend Safety Scores, better VL Safety Ranks, and better Great Recession Performance score higher in David Van Knapp’s defensiveness scoring sytem. The maximum possible score is 12 (3 points in each of 4 categories).

Screening and Ranking

For this month’s article, I used the following screens:

- Defensiveness scores of 11 or 12

- Price is below my risk-adjusted Buy Below price

My risk-adjusted Buy Below prices allow premium valuations for the highest quality stocks, but require discounted valuations for lower quality stocks.

I use a survey approach when estimating fair value, collecting fair value estimates and price targets from several sources, including Morningstar, Finbox, and Portfolio Insight. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to eleven estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my fair value estimate.

The latest Dividend Radar (dated December 3, 2021) contains 733 stocks. Of these, 56 have defensiveness scores of 11 or 12, but only 29 trade below my risk-adjusted Buy Below price.

I ranked these candidates by sorting their quality scores (as determined by DVK Quality Snapshots) in descending order and used the following metrics, in turn, to break any ties:

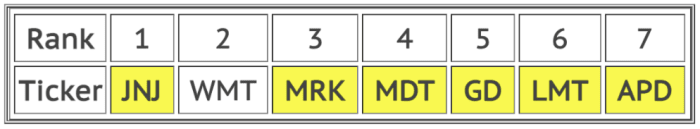

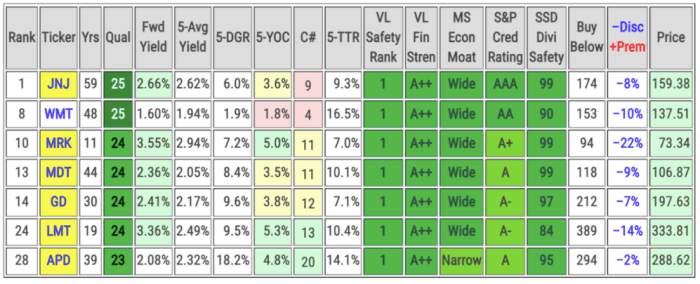

The tables below show this month’s picks in rank order.

7 Top-Ranked Dividend Growth Stocks for December

Here are top-ranked dividend growth stocks that passed this month’s screens:

I own the six highlighted stocks in my DivGro portfolio.

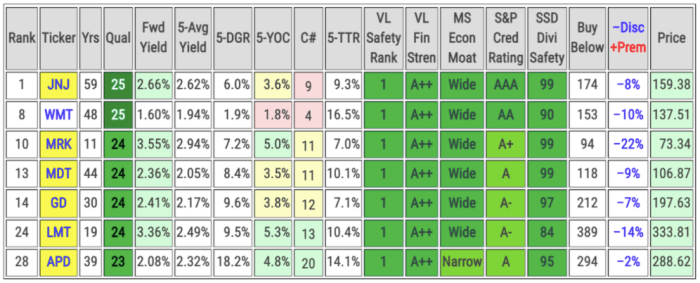

Below, I provide a table with key metrics of interest to dividend growth investors:

The Fwd Yield column is colored green if Fwd Yield ≥ 5-Avg Yield.

Key metrics and fair value estimates of December’s Top 7 Dividend Growth Stocks (includes data sourced from Dividend Radar).

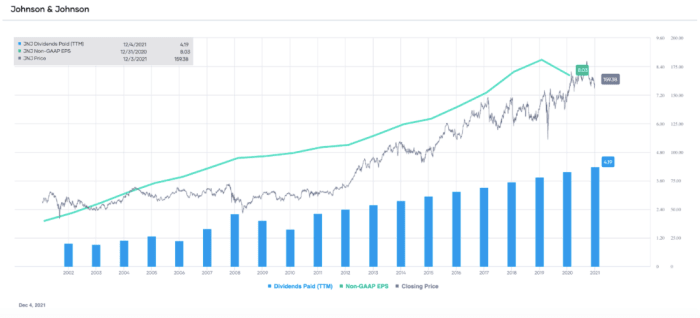

Next, let’s look at each stock in turn. All data and charts are courtesy of Portfolio-Insight.com.

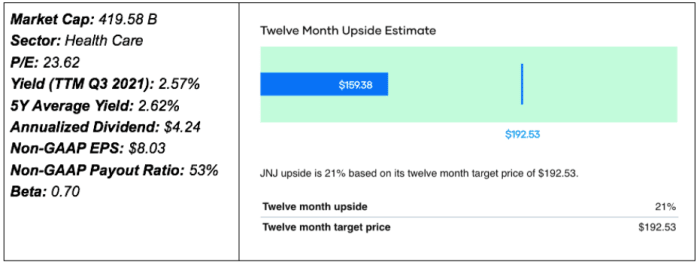

Johnson & Johnson (JNJ)

Founded in 1886 and based in New Brunswick, New Jersey, JNJ has grown into one of the largest companies in the world. The company is a leader in the pharmaceutical, medical device, and consumer products industries. JNJ distributes its products to the general public, retail outlets and distributors, wholesalers, hospitals, and health care professionals.

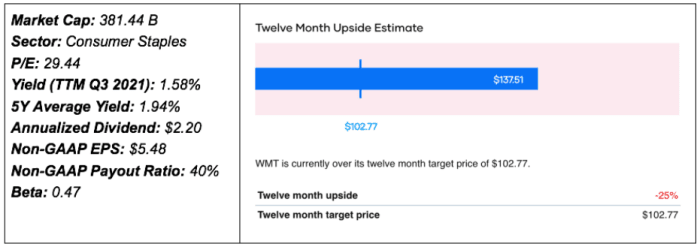

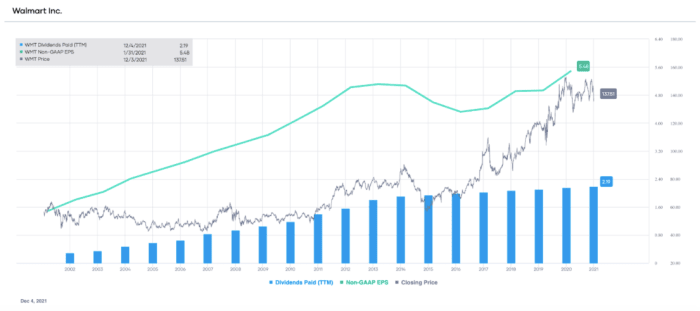

Walmart Inc (WMT)

WMT is the world’s largest retailer and the biggest private employer in the world. Based in Bentonville, Arkansas, and founded in 1962, the company is a multinational retailer with more than 11,000 stores worldwide. Additionally, the company operates e-commerce websites in many countries. WMT operates through three segments: Walmart U.S., Walmart International, and Sam’s Club.

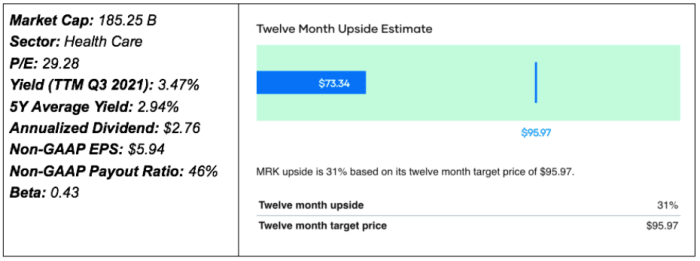

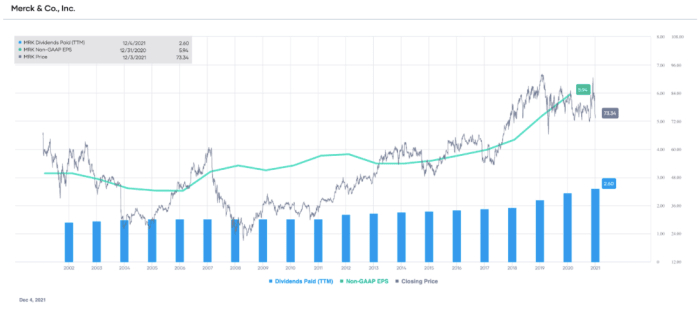

Merck & Co, Inc (MRK)

Founded in 1891 and headquartered in Kenilworth, New Jersey, MRK is a global health care company that offers health solutions through prescription medicines, vaccines, biologic therapies, and animal health products. MRK markets its products to drug wholesalers and retailers, hospitals, government entities and agencies, physicians, physician distributors, veterinarians, distributors, animal producers, and managed health care providers.

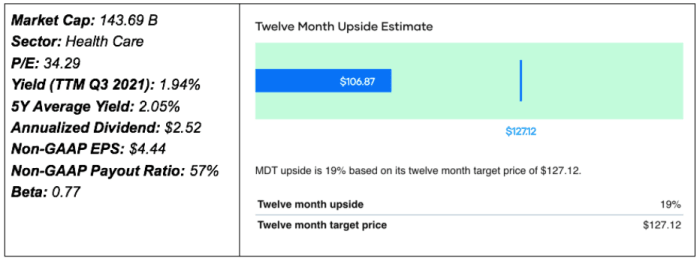

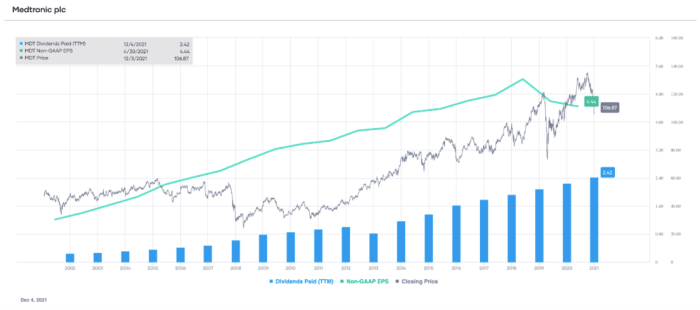

Medtronic plc (MDT)

MDT manufactures and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. The company operates in four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group. MDT was founded in 1949 and is headquartered in Dublin, Ireland.

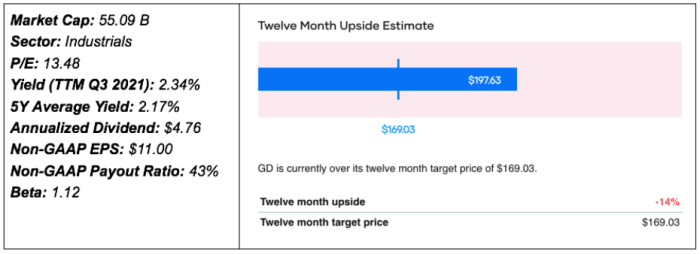

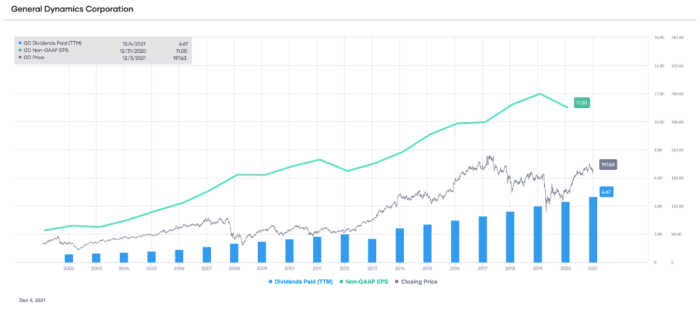

General Dynamics Corporation (GD)

Headquartered in Falls Church, Virginia, GD is an aerospace and defense company offering products and services in business aviation; land and expeditionary combat systems, armaments and munitions; shipbuilding and marine systems; and information systems and technologies. Formed in 1952, GD has grown steadily through the acquisition of many businesses.

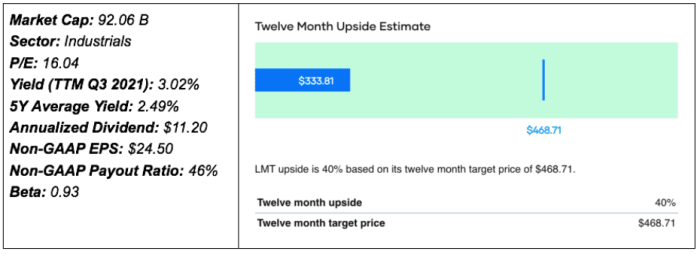

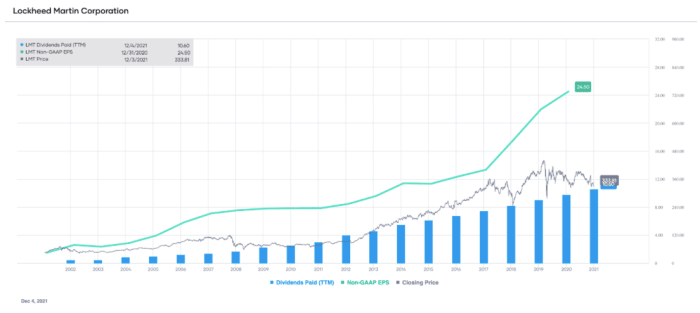

Lockheed Martin Corporation (LMT)

Founded in 1909 and headquartered in Bethesda, Maryland, LMT is a global security and aerospace company engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems. LMT operates through four segments, Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space Systems.

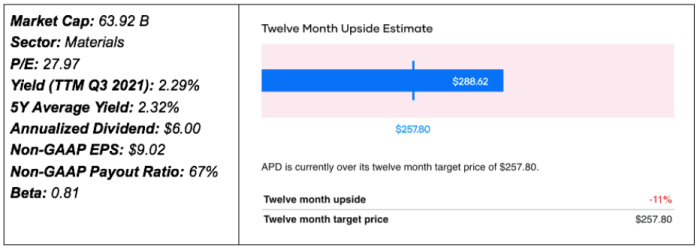

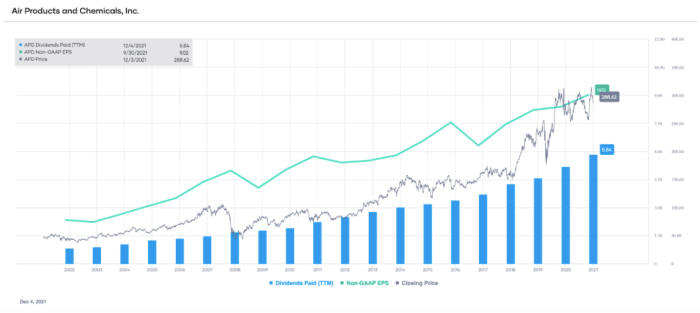

Air Products and Chemicals, Inc (APD)

Founded in 1940 and headquartered in Allentown, Pennsylvania, APD produces atmospheric gases (such as oxygen and nitrogen), process gases (such as hydrogen and helium), and specialty gases, as well as the equipment for the production and processing of gases. APD also provides semiconductor materials, refinery hydrogen, natural gas liquefaction, and advanced coatings and adhesives.

Concluding Remarks

This month, I ranked Dividend Radar stocks with defensiveness scores of 11 or 12 out of a maximum of 12 points, according to David Van Knapp’s defensiveness scoring system. Additionally, I screened for stocks trading below my risk-adjusted Buy Below prices.

I’m long six of this month’s seven candidates. The exception is WMT, the top performer based on 5-year compound trailing total returns. While WMT has a perfect quality score of 25, I don’t like its low yield and low 5-year compound annual dividend growth rate.

All my positions are full-sized positions based on my dynamic and flexible portfolio target weighting strategy, so I’m not planning to add shares at this time.

I would recommend looking at the following stocks, depending on your investment style and goals:

- For income investors: MRK

- For value investors: LMT, MRK

- For dividend growth-oriented investors: APD

As always, I advise readers to do their due diligence before investing.

Thanks for reading and take care, everybody!

Please follow me here:

- Twitter: @div_gro

- Facebook: @FerdiS.DivGro

I’d be happy to answer any questions you may have!

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

Also read:

4 High Yield Closed-End Funds For Your Income Portfolio

2 Dividend Stocks On My Buy List

Focusing On Income, Too Many Stocks & Wrong Valuation: More Mistakes You Could Be Making

18 Dividend Stocks To Consider For The Next Decade

Hybrid Funds To Complement High Yield Portfolios

5 Discounted Dividend Contenders